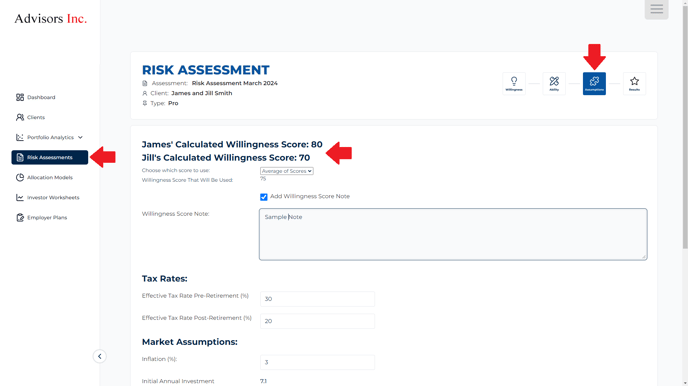

The Assumptions section allows you to pick the financial assumptions for the model.

Here are some of the highlights of the "Assumptions" page -

- Willingness Scores - When a couple completes the Willingness questionnaire separately, you can select whose score you want to use on the Ability page. The numbers shown here translate to the numerator in a stocks-to-bonds ratio. You can choose either one of their scores, an average of the two, or a score override based on conversation with your clients. Keep in mind that for compliance purposes, you will have to add a note if you choose to do an override.

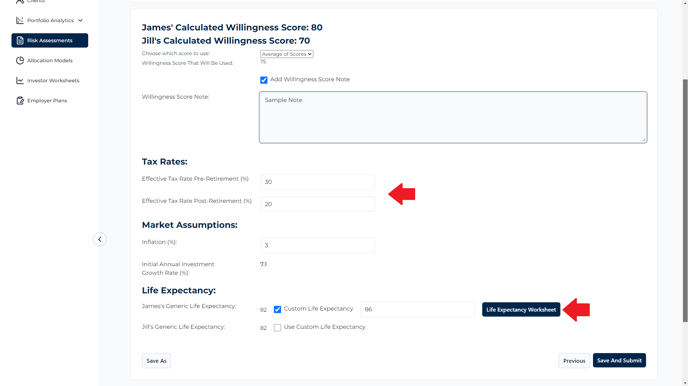

- Inflation and Tax Rates - The Inflation Rate will populate with the value you have set in Defaults. The Pre and Post Retirement Effective Tax Rates should be entered based on the clients' expected Federal, State, and Local tax rates (combined). These rates are Effective, not Marginal, meaning they are the actual rate paid by the client on all income, not the tax on an additional dollar of income.

- Life Expectancy Worksheets - The life expectancy worksheet here will help you account for factors such as lifestyle, genetics, and gender to improve the accuracy of the results related to their probability of running out of money. In the case of spouses, we use "second-to-die" mortality probabilities. You can also use custom numbers here.

The video below walks you through the information above -